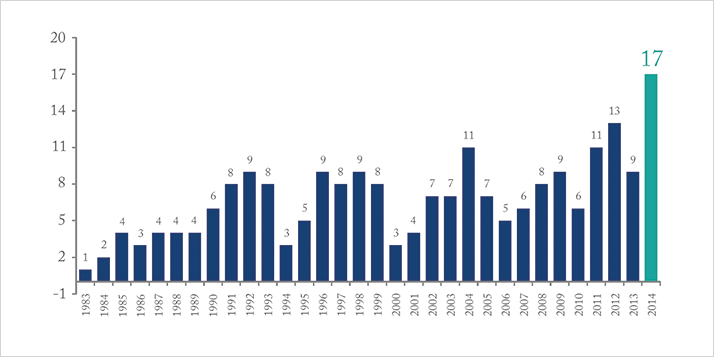

In January, we reported that the European Medicines Agency issued a record number of positive opinions (17) for medicines for rare diseases in 2014. And the same trend can be seen in the US; the FDA approved 41 new molecular entities – 17 of which were for rare diseases in 2014, the largest number since the Orphan Drug Act was first passed in 1983.

A recent white paper from GlobalData attempts to identify the reasons behind the industry’s newfound focus on orphan medicines (1). In short, it’s all about strategy. “Developing orphan drugs not only makes strategic sense, but also financial sense,” says Adam Dion, a healthcare industry analyst at GlobalData. “There is a need for the industry to replenish its product pipeline and to more rapidly access commercialization revenues. Orphan medicines typically have lower clinical trial costs and other benefits, such as tax credits and waiver of user fees.” Manufacturers are also attracted by the high price commanded by orphan medicines. In December 2014, Amgen announced that its new acute lymphoblastic leukemia drug (Blincyto) would cost $178,000 per year per patient. Alexion Pharmaceutical’s Soliris – the world’s most expensive drug – is also an orphan product. The monoclonal antibody drug approved for treating paroxysymal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome costs $409,500 in the US. In the UK, the drug was recently approved by the country’s healthcare cost watchdog, NICE, and will cost around £340,000 per patient per year.

“Amgen has come under fire for the price of Blincyto – it’s one of the most expensive cancer treatments,” says Dion. “Orphan drug affordability is now a big issue for payers and governments. Healthcare costs are exploding worldwide and there are some very difficult questions being asked about whether the prices of orphan drugs are justifiable or even sustainable in the long term.” For the moment, however, the white paper acknowledges that there are financial gains for companies involved in developing and commercializing orphan medicines. In a peer group analysis of sales data for 50 orphan drugs, the paper estimated combined sales in 2013 at around $48 billion. This is expected to reach almost $90 billion in 2019.

References

- GlobalData, “Drug Approvals Reveal an Industry Shift to Rare Diseases”(January, 2014), http://healthcare.globaldata.com/resources/white- papers/drug-approvals-reveal-an-industry-shift- to-niche-diseases