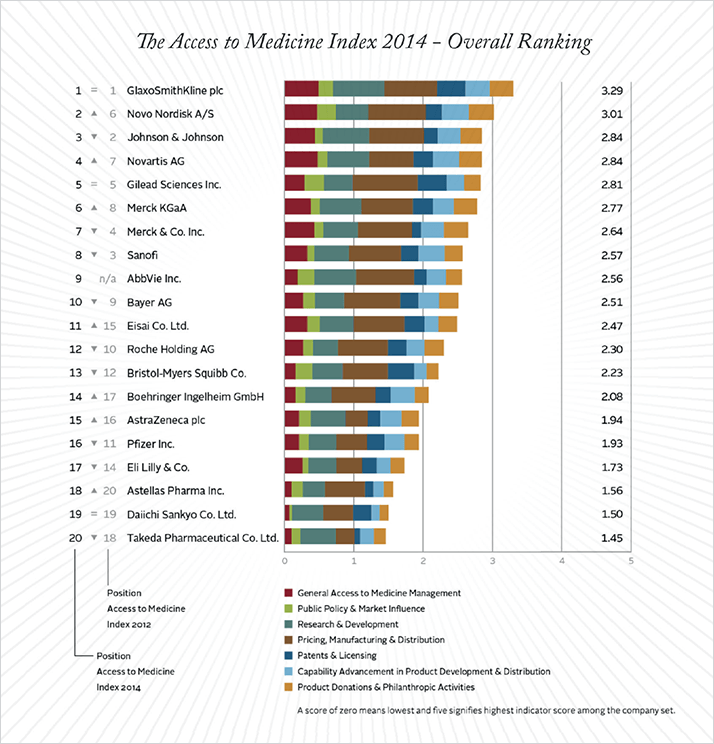

Are pharma companies doing enough to improve access to medicine in developing countries? It’s a question that is very much in the public eye right now, given the Ebola crisis. According to the 2014 Access to Medicine Index, released in mid-November, companies are getting better at facilitating access, but there is still some way to go.

Wim Leereveld, founder and CEO of the Index, featured in our first “Sitting Down With” interview and explained its ambitious aims. In a nutshell, the Index is released every two years and ranks leading pharma companies on their efforts to improve access to medicines in developing nations. You can see the top performers in the table, and how their rankings compare with last year.

Starting with the positive, the Index shows that the number of “relevant” products in the pipeline has grown; for example, Merck & Co. is investigating a new antifungal drug for the neglected tropical disease Chagas, and GlaxoSmithKline is developing a low-cost inhaler and chronic obstructive pulmonary disease drugs for use in developing countries. Since 2012, several important products for developing nations have also come to market, including the first new drug in 40 years for multi-drug resistant tuberculosis (Johnson & Johnson), a child-dose HIV tablet (also Johnson & Johnson) and a new pill that can cure hepatitis C (Gilead). The conditions seeing most attention are lower respiratory infections, diabetes, hepatitis, HIV and malaria. Neglected tropical diseases are also a little less neglected than they were a few years ago, and more than half of the companies in the index are developing pediatric versions of medicines. However, ranking well in the Index is not just about how many relevant products you have; it’s more about what you do with them. The Index notes that companies are paying more attention to people’s ability to pay, and exploring new business models that facilitate access to medicines in poorer countries, for example, issuing licenses that allow generic versions of drugs to be distributed in developing countries.

Despite all this positive action, the Index identifies two key areas where the industry is lagging behind. Firstly, the Index notes that companies are still “conservative” in their approach to patents and tend to be cagey in revealing where patents are active and when they will expire. An example of this situation can be seen on page 12 where Sandoz was unaware of a patent protecting an Amgen product. Secondly, all but two of the companies in the Index have been involved in cases related to ethical marketing, bribery or corruption in the last two years. Overall though, the picture is one of incremental improvement. As Leereveld told The Medicine Maker, “These companies are like oil tankers; an oil tanker can change direction, but only a few degrees at a time. We must be patient. I am convinced that companies are making positive long-term decisions.”