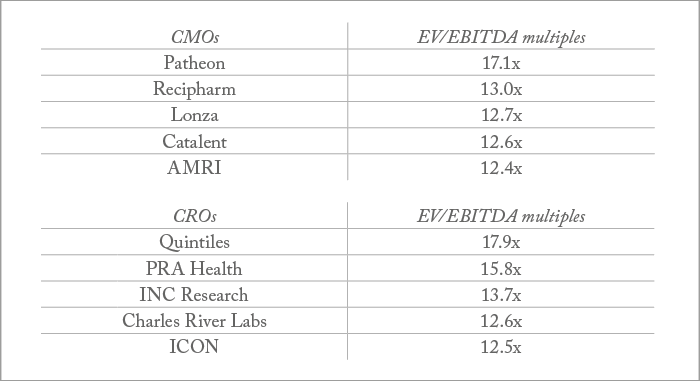

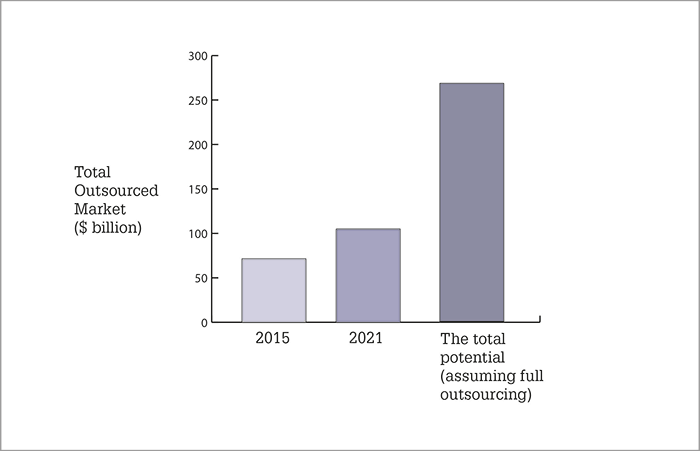

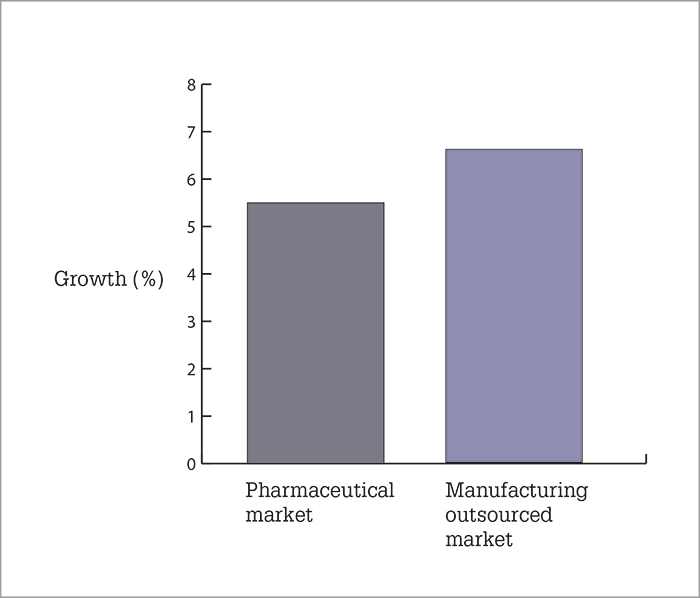

Results Healthcare have published a review of outsourced manufacturing in pharma and biotech – and the news is good for the sector (1). The headline figure is an expected growth figure of 6.6 percent – well above the expected global GDP growth. This, the authors claim, is driven by the strong growth of the overall pharmaceutical sector, as well as an increase in the amount of outsourced manufacturing work. Over the next four years, growth is expected to be dedicated to small molecules and commercial manufacturing supply. Here are some of the key findings.

Top five major investments in recent years:

- New HPAPI facility in Shanghai by WuXi in 2014.

- Expansion of existing capacity at UK HPAPI facility by DPx/Patheon in 2014.

- Fareva announcement of a €25-million investment in a recently acquired asset in La Vallé, France, to add HPAPI capable facilities in 2015.

- Fermion announcement in 2016 of a €30-million investment in its Hanko, Finland, facility which will add additional HPAPI capacity.

- Alcami due to open a new 500 m2 kilolab-scale facility during Q1 2017.

Company strategy findings:

- Most western companies see themselves as differentiated players.

- One-stop-shop is a popular strategy pursued by the large players.

- In the atmosphere of consolidation, size has been a goal for acquisitions.

- M&A is not a strategy followed by all, linked to the peculiarities of private and family ownership.

References

- Results Healthcare, “Pharma & biotech 2017 Review of outsourced manufacturing”, (2016). Available at: http://bit.ly/2k3gppE. Last accessed February 28, 2017.